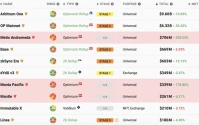

So, apparently, DeFi investors are now flocking to "safer" names after the October crash. Buybacks and "fundamental catalysts" are the new black, according to FalconX. Give me a break. "Safer" in DeFi is like saying a slightly less rusty car is "safer" when it's still hurtling toward a brick wall. It's all relative, people.

HYPE and CAKE are getting some love because of buybacks. MORPHO and SYRUP are outperforming because they weren't completely wrecked by the Stream finance collapse. What a ringing endorsement. It's like celebrating that your house only burned down halfway.

And let's dissect this "fundamental catalyst" BS for a second. Minimal impact from a collapse? Seeing growth "elsewhere"? Translation: they're not totally dead yet. These "catalysts" are just code for "managed to avoid complete and utter annihilation."

Subsectors: Cheap or Just...Cheaper?

Oh, and get this: some DeFi subsectors are now "cheaper" relative to September 30. Well, offcourse they are. When everything's down 37% QTD, something's gotta be cheaper, right? Doesn't mean it's a bargain; it just means it's lost less value than the other garbage.

Spot and perpetual DEXes have declining price-to-sales multiples because their prices declined faster than protocol activity. Okay, so the price is tanking faster than people are ditching the platform. That's not exactly a sign of health, is it? It’s like saying your business is doing great because your losses are only increasing slightly slower than your revenue is disappearing.

CRV, RUNE, and CAKE posted greater 30-day fees. Whoop-dee-doo. It's like bragging that you made slightly more money panhandling this month compared to last. The bar is in hell.

And then there's the lending sector. Market cap fell 13%, but fees declined 34%. So, investors are piling into lending names because they think it's "stickier" than trading. Stickier like tar, maybe. This is what passes for optimism these days?

Prediction Markets? More Like Desperation Markets

Gaspar from FalconX thinks perps will continue to lead. Okay, maybe. But he also mentions "prediction markets" are seeing record volumes. Seriously? People are betting on the future because they can't make money any other way? That's not a sign of a healthy market; that’s a sign of widespread desperation. It's like saying the lottery is booming because everyone's doing so well financially.

Investors may be looking to fintech integrations to drive growth. AAVE's high-yield savings account and MORPHO's Coinbase integration are supposed to be examples of this. Right, because shoving DeFi into the traditional financial system is definitely going to solve all the problems. It's like trying to fix a broken toaster by plugging it into a nuclear reactor.

It’s all just a distraction from the fact that DeFi is still a house of cards waiting to collapse. Then again, maybe I'm the crazy one here. Maybe I should just shut up and buy some CAKE. Nah.

This is Just Rearranging Deck Chairs on the Titanic

Look, DeFi is a mess. Let's be real. These "trends" and "opportunities" are just people trying to make sense of a dumpster fire. DeFi Token Performance & Investor Trends Post-October Crash They expect us to believe this nonsense, and honestly... I can't even. Give it a year, and we'll be talking about the next "safer" bet that turned out to be just as screwed as the last one. Ain't gonna happen.