SECURE OUTPUT

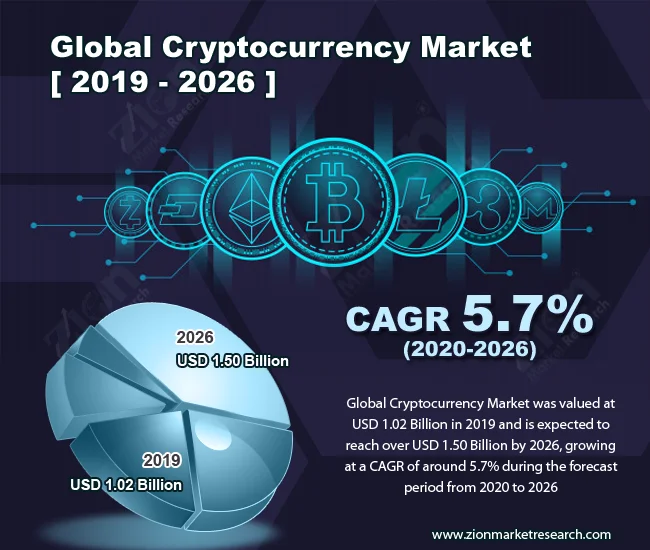

Introduction: The Geopolitical Risk Game of Crypto Regulation in 2025

The global crypto regulatory landscape in 2025 is less a level playing field and more a chaotic game of geopolitical Risk. Some countries are clearly making strategic moves, while others are lagging, creating opportunities and risks that any serious investor needs to understand. Let's cut through the noise and look at what the numbers actually tell us about who's winning this game.

The Stablecoin Scramble and Institutional Stampede

The TRM Labs report highlights that over 70% of jurisdictions progressed stablecoin regulation in 2025. That's a significant number, but it's the quality of that regulation that matters, not just the quantity. The US's GENIUS Act and the EU's MiCA rollout are frequently cited as examples. But, dig deeper, and you see a discrepancy. MiCA, while comprehensive, is already facing challenges with uneven implementation, as regulators in France, Austria, and Italy have pointed out. The US, on the other hand, is pushing forward with a more innovation-friendly approach, particularly under the Trump administration.

This regulatory clarity is directly fueling institutional adoption. The report states that about 80% of jurisdictions saw financial institutions announce digital asset initiatives. But where are these initiatives concentrated? The US, EU, and parts of Asia with "clear, innovation-friendly regulation." Jurisdictions with unclear rules are seeing a more cautious stance. It's a classic case of capital flowing to where it's treated best. Texas, for example, became the first US state to publicly invest in Bitcoin. It's a symbolic move, yes, but symbols matter when you're talking about attracting long-term investment.

Cracking Down on Crypto Crime

The push for regulation isn't just about attracting investment; it's also about combating illicit finance. TRM analysis found that regulated VASPs have significantly lower rates of illicit activity than the overall ecosystem. That's not exactly a shocker, but it does quantify the impact of regulation. The North Korea's Bybit hack, which led to the loss of over USD 1.5 billion in Ethereum tokens, underscores the need for better cross-jurisdictional coordination. The attackers exploited unregulated or lightly supervised technologies to obscure funds.

International bodies like the FATF and FSB are pushing for global consistency, warning that gaps in standards implementation could pose risks to financial stability. But consistency is a pipe dream. The reality is that different countries have different priorities and different levels of resources. Some, like the Seychelles, are tightening VASP oversight, while others, like El Salvador, are experimenting with Bitcoin as legal tender (though they’ve since walked back the mandatory acceptance requirement). It's a patchwork of approaches, and that creates opportunities for arbitrage – both legitimate and illicit.

The Bitcoin Price Puzzle: Stability or Sell-Off?

Despite all this regulatory activity, Bitcoin's price has been volatile. The December 1st update notes a 6.4 percent drop in Bitcoin's price, influenced by expectations of a Bank of Japan rate hike. But that's just one factor. Farzam Ehsani, CEO of VALR, points to concerns about MSCI potentially excluding major crypto-holding companies like Strategy from global indices. If that happens, expect forced sell-offs and further weakening of market structure.

The key question is whether Bitcoin can hold above roughly US$85,200 to avoid deeper bearish territory. Technical support levels lie around US$86,000 to US$79,600, with further downside possible to US$67,700. A funding rate of -0.001 percent reflects mild bearish sentiment, but the RSI at 32.58 marks deeply oversold territory. So, what's the takeaway? The market is in a "strong correction and restructuring phase," according to Linh Tran, a market analyst at XS.com. Long liquidation cleared weak positions, potentially setting a cleaner base for future recovery. I've seen this pattern play out dozens of times. The question is whether the institutional players will step in at lower levels.

Where's the Alpha? Regulatory Arbitrage

The global crypto regulatory landscape is a mess, but that mess creates opportunities. The key is to identify the jurisdictions that are striking the right balance between innovation and regulation. The US, despite its political divisions, seems to be heading in that direction. The EU, while comprehensive, may be too rigid. And countries like El Salvador are too risky.

The real alpha, in my opinion, lies in regulatory arbitrage. Identifying companies that can navigate this complex landscape and capitalize on the differences between jurisdictions is where the smart money will be made. It's not about picking the next Bitcoin; it's about picking the companies that can build a sustainable business in this evolving regulatory environment.