DeFi Post-Crash: Bargain or Bust?

The DeFi sector is still reeling from the October 10th crypto crash, and the question on everyone's mind is simple: bargain or bust? FalconX's recent report paints a mixed picture, and frankly, the "mixed" part is what worries me most. It's not the outright losses – those are expected in a downturn – but the unevenness of the recovery that suggests deeper structural issues at play.

The Uneven Landscape of Losses

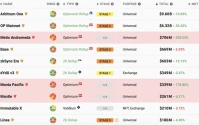

The headline figure is stark: only 2 out of 23 leading DeFi tokens are in positive territory year-to-date as of November 20th. The group is down an average of 37% quarter-to-date. But averages can be deceiving. Diving deeper, the report highlights that some tokens, specifically those with buyback programs (like HYPE and CAKE), or those benefiting from "idiosyncratic catalysts" (MORPHO and SYRUP), have outperformed their peers.

This outperformance isn't necessarily a sign of underlying strength in the DeFi sector as a whole. Instead, it suggests a flight to perceived safety, or a bet on short-term, token-specific events rather than a broader recovery. Buybacks, while potentially boosting price, are ultimately financial engineering, not organic growth. (They're the corporate equivalent of putting lipstick on a pig, if you ask me). And "idiosyncratic catalysts?" That’s just Wall Street speak for "lucky."

The real problem here is that investors are rewarding tokens for not collapsing as badly as others, not for actually delivering innovation or value. It's a low bar, and one that doesn't inspire confidence in the long-term health of the sector. I mean, MORPHO outperformed because it saw "minimal impact from the Stream finance collapse." Congratulations, you weren't the most exposed to a disaster. That's your catalyst?

Shifting Valuations and Lending Sector Dynamics

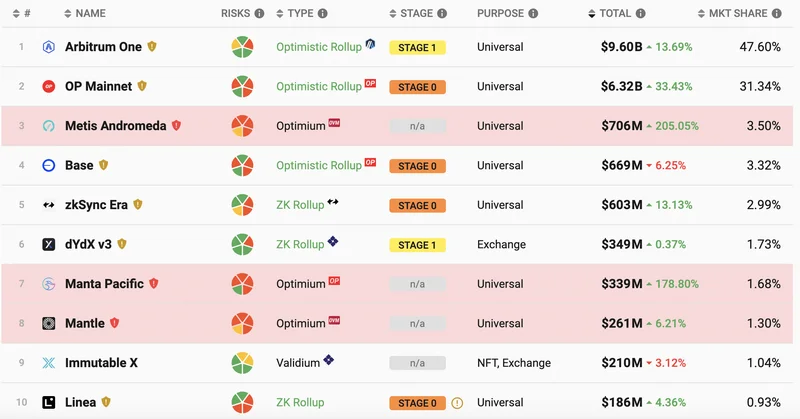

The FalconX report also points to a shifting valuation landscape within DeFi. Spot and perpetual decentralized exchanges (DEXs) have seen price-to-sales multiples compress – their prices fell faster than their activity. This sounds bad, but it could also be interpreted as a healthy correction, bringing valuations back in line with reality. However, the lending sector presents a more concerning picture. Lending and yield names have generally seen multiples increase, as prices haven't fallen as much as fees. KMNO, for example, saw its market cap fall 13%, while fees declined 34%.

This discrepancy suggests that investors are crowding into lending names, viewing them as "stickier" during the downturn. The logic is that even in a bear market, people will still seek yield on their stablecoins. But this crowding effect could be creating a bubble, artificially propping up lending token valuations despite declining underlying activity. It's like everyone piling into the same lifeboat – it might feel safer in the short term, but it increases the risk of capsizing.

And here’s the part of the report that I find genuinely puzzling. The report states that lending activity "may even pick up as investors exit to stablecoins and seek yield opportunities." This seems contradictory. If investors are exiting to stablecoins, that implies they're de-risking, not necessarily looking for high-yield opportunities. Are they really that yield-hungry, or are they just parking their assets temporarily? The report doesn't provide enough data to answer this question definitively.

Methodological Transparency Concerns

Now, before we go any further, let's stop and think about how FalconX gathered this data. Were these on-chain metrics? Surveys of institutional investors? The report doesn't say. This lack of methodological transparency makes it difficult to assess the reliability of their findings. It's one thing to report numbers; it's another to explain where those numbers came from and what biases might be inherent in the data collection process. DeFi Token Performance & Investor Trends Post-October Crash provides further analysis of investor behavior following the crash.

Is This A Buying Opportunity or A Trap?

So, back to the original question: is this a buying opportunity, or a trap? The FalconX report, while informative, doesn't provide a clear answer. The uneven performance across DeFi subsectors, the potential bubble in lending names, and the methodological opacity of the report itself all raise red flags. It would be foolish to go all in based on this data.

However, that doesn't mean there aren't selective opportunities. Tokens with strong fundamentals, demonstrated utility, and sustainable revenue models may indeed be undervalued after the crash. But identifying those gems requires a much deeper dive than this report provides. We need to look at on-chain activity, developer engagement, and real-world adoption metrics, not just price charts and buyback announcements.

I've looked at hundreds of these filings, and this particular one is unusual, because it focuses on buyback. This is just one of the many reasons I won't be throwing my hat in the ring.

Selective Optimism, Data Required

The October crash wasn't a uniform event; it was a stress test that revealed the underlying weaknesses in the DeFi sector. Some projects passed; others failed. The key is to distinguish between the two, and that requires a data-driven, skeptical approach—not blind faith in narratives or short-term market movements. The sector needs a serious re-evaluation, and maybe, just maybe, a few select projects will emerge stronger. But for now, proceed with extreme caution.