Crypto Winter Thaws? A 2026 Reality Check

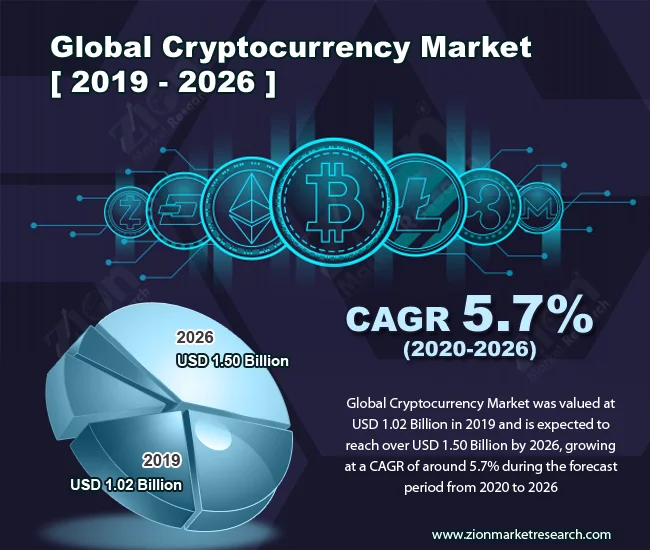

Initial Market Optimism

Bitcoin's recent surge back above $90,000 is undeniably eye-catching. News outlets are proclaiming the end of "crypto winter," fueled by expectations of Federal Reserve rate cuts and the perennial "Santa Rally." But before anyone starts popping champagne, let's inject some data-driven sobriety into this narrative. Are we witnessing a genuine resurgence, or just a temporary blip in a longer-term downtrend?

The initial signs are promising, if you squint. Bitcoin logged a gain of over 6% in a single session, a strong recovery after weeks of decline. The renewed "risk-on" sentiment is palpable. Investors are indeed rotating out of traditional safe havens like the US dollar, seeking higher returns in riskier assets. The expectation of a 0.25% rate cut by the Federal Reserve next week (bringing the benchmark rate down to 3.75%) is a key driver. But policy decisions are always subject to change, and this is something to keep in mind.

Institutional and Retail Participation

Open interest in Bitcoin futures is also on the rise, currently sitting at $29.2 billion. This suggests that institutional investors are cautiously dipping their toes back into the water, accumulating buying positions. Retail participation is also up, with active Bitcoin addresses climbing to 851,430. Again, these are good numbers. The question is: can they be sustained?

Bitcoin Treasury Companies: A Canary in the Coal Mine?

The Role of Bitcoin Treasury Companies (DATs)

To get a clearer picture, let's look at Bitcoin treasury companies (DATs). These firms, which hold large Bitcoin reserves on their balance sheets, act as a leveraged play on the cryptocurrency. Their performance can offer insights into the overall health and sentiment of the crypto market. Galaxy Research sounded a warning about these companies months ago, essentially stating that their model only works if their equity trades at a premium to its BTC net asset value (NAV). That premium, fueled by a cycle of price, issuance, and accumulation, is now under severe pressure.

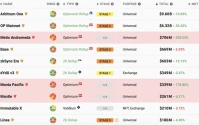

Declining Equity Valuations and NAV Premiums

The data paints a stark picture. DAT equity valuations have plummeted. Companies that once traded at significant premiums to their NAV are now often trading at a discount. Take Nakamoto (NAKA), for example. The stock has suffered a drawdown of over 98% from its 2025 highs – a wipeout reminiscent of the memecoin frenzy. Even Strategy (MSTR), the largest corporate Bitcoin holder, has seen its equity premium compress significantly.

Amplified Losses and Financial Leverage

And this is the part of the report that I find genuinely puzzling. The magnitude of these drawdowns far exceeds the decline in Bitcoin itself. Bitcoin is down roughly 30% from its highs. DAT equities, however, have combined operational, financial, and issuance leverage, amplifying both gains and losses. It’s a triple whammy, and it's hitting these companies hard.

Metaplanet's Unrealized Profit and Loss (PnL)

Metaplanet's unrealized profit and loss (PnL) dashboard illustrates this dramatic shift. In early October, the company boasted over $600 million in unrealized profits. As of December 1st? They're showing approximately $530 million in unrealized losses. That's a swing of over a billion dollars in less than two months. The Galaxy Research data confirms this trend across the board. Metaplanet and Nakamoto have average BTC costs above $107,000, meaning their unrealized P&L is firmly in the red. DAT’s All, Folks? What’s Next for Bitcoin Treasury Companies

The Downside of Financial Engineering

The mechanism is simple, but brutal: Lower BTC price leads to lower BTC NAV per share, which compresses equity premiums, reducing the ability to issue shares accretively. It's the same financial engineering that amplified the upside, now magnifying the downside. The core KPI – BTC per share – which determines whether issuance is accretive or dilutive, is now stagnating or declining. Investors are starting to ask if some firms may eventually need to sell their Bitcoin holdings to stay afloat.

Plausible Outcomes for DATs

What happens now? Galaxy Research outlines three plausible outcomes: Premiums stay compressed, selective survival and consolidation, and optionality on the next cycle. I suspect we'll see a combination of all three.

Base Case: Compressed Premiums and Leveraged Downside

The base case is that most DATs will continue to trade at flat or negative premiums to NAV as long as crypto markets remain soft. Their equities will offer levered downside, not upside, versus spot Bitcoin. This drawdown is also a balance sheet stress test. Companies that issued the most stock at the highest premium, bought the most Bitcoin at cycle-top prices, and layered on debt against those holdings are the most vulnerable. We can expect potential restructurings and stronger players, such as Strategy, to acquire weaker ones at a discount or simply outlast them. Strategy's recent announcement of a $1.44 billion cash reserve (funded via at-the-market equity sales) is a clear signal that they're preparing for a prolonged period of compressed premiums and weaker Bitcoin prices.

The Future of Treasury Companies

In principle, the treasury company trade isn't dead. If and when Bitcoin eventually prints new all-time highs, some subset of these companies will likely regain modest equity premiums and reopen the issuance flywheel. However, the bar is now much higher. Boards and management teams will be judged on how they handled this first real stress test.

Numbers Don't Lie, Narratives Can

A Nuanced Reality

The recent Bitcoin rally is encouraging, but the struggles of Bitcoin treasury companies serve as a stark reminder of the inherent risks and volatility in the crypto market. While the narrative of a thawing crypto winter is appealing, the data suggests a more nuanced reality. A sustained recovery requires more than just short-term optimism and Federal Reserve rate cuts. It requires a fundamental shift in market sentiment, a return of institutional confidence, and, perhaps most importantly, responsible financial management by crypto companies. The rally may have been triggered by a short squeeze. The data suggest to me that the market remai